Book value per share calculator

Stock holders equity Preferred Stock Total outstanding shares. The book value per share is the value each share would be worth if the company were to be liquidated all the bills paid and the assets distributed.

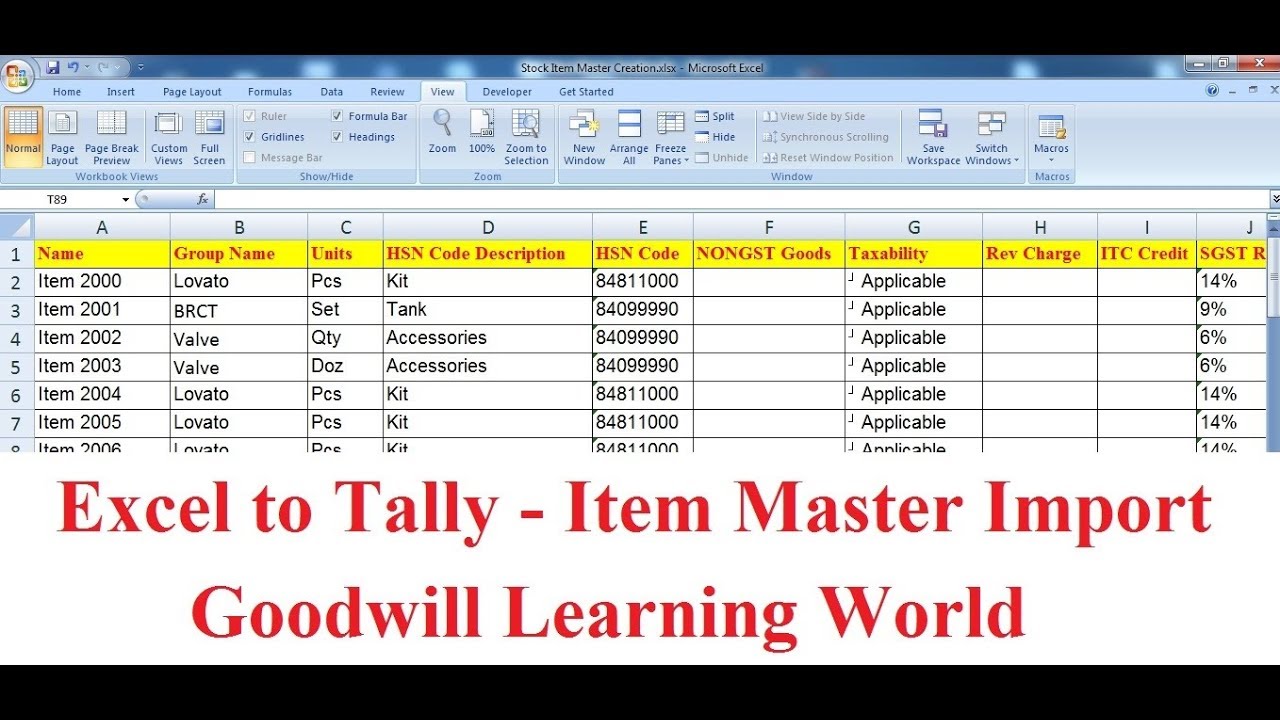

Tally Tdl For Excel To Tally Stock Item Master Import With Group And Excel The Unit Master

Book Value Per Share Calculator - calculate the book value per share of a company based on its total equity available to common shareholders.

. The formula for price to book value is the stock price per share divided by the book value per share. Book Value Per Share Calculator for Preferred Stock. Book Value Per Share BVPS 16bn Book Value of Equity 14bn Common Shares Outstanding.

Book value per share is calculated by dividing. It makes the life of a Businessman easy. Book value per share is used as an indication of the underlying value of a company compared with the current trading price of the companys stock.

Book value per share BVPS is the method of calculating a companys share value. Book value per share 200000 2000. Formula How to calculate.

0 commission on online stocks ETFs. This calculator will compute the book value per share for a companys preferred stock given the liquidation value of the preferred stock. Book Value per Common Share Calculation.

So the result here is 100 which means the. Book Value Per Share Calculator. If book value is negative where a companys liabilities exceed its assets this is known as a balance sheet insolvency.

The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders. This is why a stock when traded is more valuable at its closing price than it is at its. The stock price per share can be found as the amount listed as such through the.

Book Value Per Share Definition. Book Value per share Total common shareholders equity Number of common shares. Calculations and knowing the exact value of Book Value Per Share Calculator will save lots of precious time.

Book For instance intangible factors impact the associated with a companys shares in addition to are left out there when calculating typically the BVPS. The formula for BVPS is. Book Value Per Share Definition.

Market to Book Ratio 697. The book value per share may be used by some investors to determine the equity in a company relative to the market value of the company which is the price of its stock. Book value per Share.

Market to Book Ratio Market Capitalization Book Value. The Book Value Per Share Calculator is used to calculate the book value per share. Book Value per Share Shareholders Equity Preferred Equity Total Outstanding Common Shares.

BVPS frac text Total. The book value per share is the value each share would be worth if the company were to be liquidated all the bills paid and the assets distributed. Present Value PV and Future Value FV Number of Periods Calculator.

Now by using the below formula we can calculate Book Value Per Share. Perpetuity Yield PY Present Value of Perpetuity PVP and Perpetuity Payment PP Calculator. This method is very helpful for the investors to find whether the stock.

As for the next projection period Year 2 well simply extend each. Now lets calculate the Shareholders Equity first. The term book value is a companys assets.

Here is the workout. Market to Book Ratio 821979400000 117892000000. The two ways of calculating the same ratio are.

It is the intrinsic value of a company that is used to determine what it is worth to buy or sell.

Compound Interest Problem Solving On Casio Classwiz Calculator Fx 991ex Calculator Problem Solving Solving

Accounting Ratios For Stock Market Analysis Bookkeeping Business Accounting And Finance Accounting Basics

Learn About Personal Finance Stock Market News Valuewalk Debt Equity Enterprise Value Equity Market

Financial Management Formulas Part 1 Business Strategy Management Financial Management Finance Investing

Pin By Shabicircle On Business Marketing Financial Ratio Money Management Advice Finance Investing

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Investing Stock Analysis

Free Download Position Size Calculator Fo Rex Stocks And Commodity Trading Using Microsoft Excel Forex Trading Commodity Trading Trading Courses

Fundamental Accounting Equation In 2022 Accounting Accounting Books Accounting And Finance

Accounting Ratios For Stock Market Analysis Bookkeeping Business Accounting And Finance Accounting Basics

Business Valuation Veristrat Infographic Business Valuation Business Infographic

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Fundamental Accounting Equation In 2022 Accounting Accounting Books Accounting And Finance

The Book Value Per Share Formula Is Used To Calculate The Per Share Value Of A Company Based On Its Equity Available To Co Book Value Business Valuation Shared

How To Calculate Price To Sales Ratio In 2022 Fundamental Analysis Tricky Questions Stock Market Investing

Chegg Com

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Stocks Financial Calculators